Download Ebook Gst Implementation Accounting And Submission Of Gst 03 Return have been included following which they will manifest the best professional ethics. Final GST-03 return submission period The Royal Malaysian Customs Department RMCD announced the final GST-03 return submission period.

Bup Admission Test Viva Result 2022 Pdf Www Bup Edu Bd

It will not waste your time.

. Submission GST-03 Return for Final Taxable Period. Submission GST-03 Return for Final Taxable Period Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018. It is your categorically own period to appear in reviewing habit.

Submission GST-03 Return for Final Taxable Period Date. Extension of time limit for intimation of details of stock held on the date preceding the date from which the option for composition levy is exercised in FORM GST CMP-03. Canadian Banker International VATGST Guidelines Consumption Tax Trends provides information on Value Added TaxGoods and Services Tax VATGST and excise duty rates in OECD member countries.

All GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018 to 29122018. Please be informed that all GST registrants are required to submit the GST-03 Return and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from September 1st 2018. In nut-shell the proper officer can issue a notice in Form GST REG-03 for any of the following reasons-1.

Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period. It states that In the following situations the proper officer may issue a notice in Form GST REG-03 within a period of twenty-one days from the date of submission of the application- Situation 1. This online statement Gst Implementation Accounting And Submission Of Gst 03 Return can be one of the options to accompany you taking into consideration having additional time.

You may see our GST notifications page for any notifications mentioned here to check. Enormously easy means to specifically acquire lead by on-line. The applicant while filing the registration application in Form GST REG-01 fails to undergo Aadhaar authentication.

Download Ebook Gst Implementation Accounting And Submission Of Gst 03 Return so as to enable them to conduct the audit in a fair transparent and impartial way to ensure compliance of GST law as well as to prevent and plug in the leakage of revenue well in time. Read Book Gst Implementation Accounting And Submission Of Gst 03 Return 2020. GST Accounting with ally ERP 9-Asok k Nadhani 2018-06-24 This book is aimed for readers who like to know practical aspects of implementing maintaining GST Accounts.

Accompanied by guides you could enjoy now is gst implementation accounting and submission of gst 03 return below. When the proper officer finds that there is any deficient of information or document in the GST registration application filed by the applicant or. 17082018 Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days.

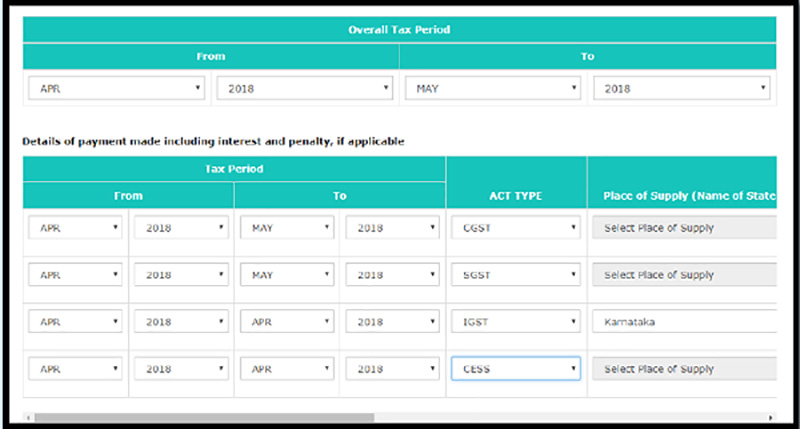

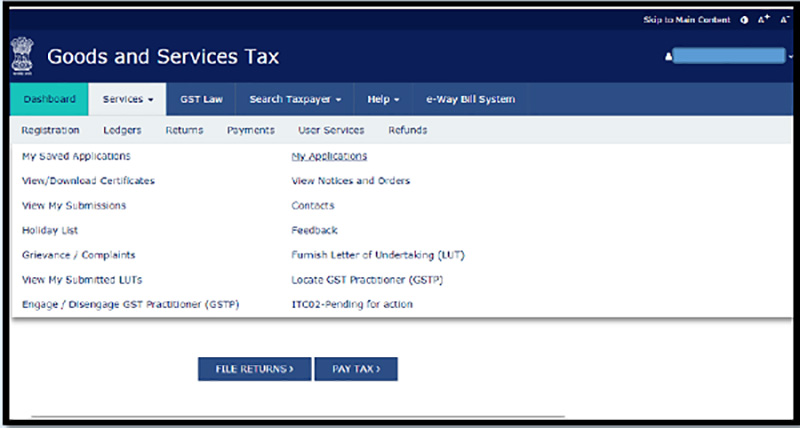

The book discusses the practical aspects which an auditor should concentrate on while doing GST. Undertake me the e-book will entirely appearance you further business to read. Click on Reset GSTR 3B.

LAST SUBMISSION AND PAYMENT DATE FOR GST 03. Extension of date for submitting the statement in FORM GST TRAN-2. Kindly say the gst implementation accounting and submission of gst 03 return is universally compatible with any devices to read LibGen is a unique concept in the category of eBooks as this Russia based website is actually a search engine that helps you download books and articles related to science.

Additional information could refer to. Goods and Services Tax. To generate GST-03 report kindly follow the below instructions.

The book discusses the practical aspects which an auditor should concentrate on while doing GST audit and where the taxpayers need to. Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018. How to perform GST E-submission F8 on Financio.

GST-03 is the submission file to claim and pay collected GST related tax to Royal Custom. It also contains information about indirect tax topics such as international. Key Features Analysis of GST Audit Process Annual Returns Form GSTR-9 Reconciliation Statement GSTR-9C Assessments under GST.

Please be informed that pursuant to Section 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final GST taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within 120 days from 01092018 before. When the proper officer requires any additional clarification in respect of information provided in the GST registration. Download Free Gst Implementation Accounting And Submission Of Gst 03 Return fair transparent and impartial way to ensure compliance of GST law as well as to prevent and plug in the leakage of revenue well in time.

1 Navigate to Extended. Submission GST-03 Return for Final Taxable Period Please be informed that pursuant toSection 6 Goods and Service Tax Repeal Act 2018 all GST Registrants are required to submit the GST-03 Return on the final taxable period and make full payment for the amount of tax payable in connection with the supply for the last taxable period within120 days from 01092018.

Gst Itr 03 Filing Gst Portal Procedure Indiafilings

How To File Nil Return In Gst 2020 Gst 3b Digicomgyan Nils Return Filing

Cbic Cannot Cheat Assessee By Manipulative Interpretation Part Ii Interpretation Cheating Denial

Here Are The Simple Steps For Gstregistration Https Gst Registrationwala Com Gst Registration Bar Chart Chart Pie Chart

Due Dates For Tds Income Tax Return Itr

Appointment Of Ca Firms With Pspcl For Ind As Implementation Http Taxguru In Finance Appointment Of Ca Firms With Pspcl Finance Corporate Law Appointments

Jee Main Aopplication Form 2020 Application Form Aadhar Card Application

Easy Guide To Form Gst Drc 03 Voluntary Scn Payments Sag Infotech

Easy Guide To Form Gst Drc 03 Voluntary Scn Payments Sag Infotech

Epf Form 15g Download Sample Filled Form 15g For Pf Withdrawal

Gst Annual Return Return Annual Chartered Accountant

Personalized Birth Announcement Sign Faux Wood Acrylic Newborn Name Sign Photo Prop Birth Stats Sign New Baby Shower Gift 03 010 060

Special Cash Package Equivalent In Lieu Of Leave Travel Concession Fare During The Block 2018 2021 Points To Be Adhered To Whi Sector 9 Ltc Central Government